TRIM Notices

What you need to know about TRIM Notices

(Truth in millage)

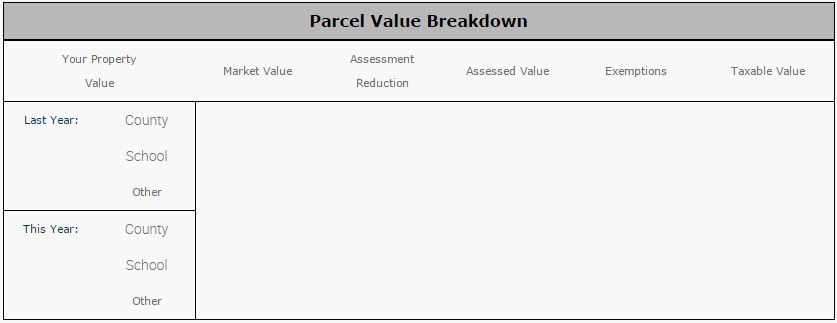

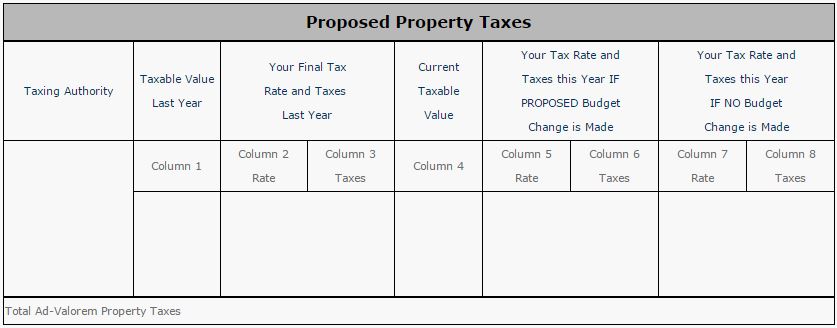

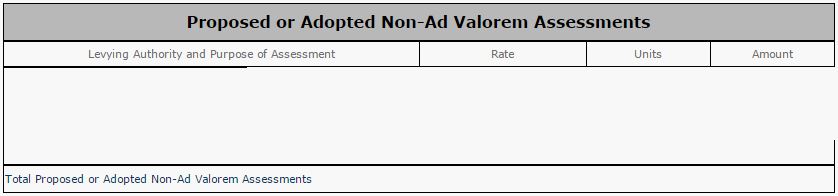

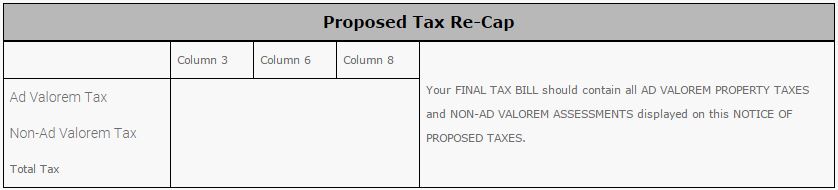

Each year, usually in August, property owners are mailed a notice by the Taxing Authorities called a Notice of Proposed Taxes or TRIM notice. This notice includes the dates, times, and places of budget meetings where tax rates are set by these agencies. Also in the notice will be information about how these tax rates could affect your individual tax bill.

These meetings are always public. Citizens are encouraged to participate in local governmental decision making.

Differing With The Property Appraiser’s Market Value Appraisal

If your opinion of the value of your property differs from the Property Appraiser’s appraisal, by all means come in and discuss the matter with us.

If you have evidence that the appraisal is more than the actual fair market value of your property, we will welcome the opportunity to review all the pertinent facts.

After talking with us, if you still find a significant difference between our appraisal and what you feel your property’s market value is, you may be heard before the Value Adjustment Board. A written application must be filed with the Clerk of the Value Adjustment Board. Petitions may be obtained from Property Appraiser or the Clerk.

Property Appraiser’s Response to COVID-19

AWARENESS

Our office is aware of the impacts that the COVID-19 crisis has had on our community and respect that many of our citizens have concerns about the value of their property as well as their property tax obligation during this challenging period.

ACTION

Under Florida law, county property appraisers must value every property in the state as of an effective date of January 1, 2020. Any impacts from COVID-19 would not impact January 1, 2020 property values, as we must analyze sales data and trends from 2019.

FUTURE

Our appraisers consistently monitor market transactions and trends. Any increase or decrease in sales prices which occur in 2020 will impact property values as of our January 1, 2021 valuation.

HOMESTEAD EXEMPTION

Due to the COVID-19 disruption, we are accepting late-filed homestead exemption applications until September 15, 2020. Please go to www.putnam-fl.com/app to see how you can submit your application.

Petition to the Value Adjustment Board

The Value Adjustment Board has no jurisdiction or control over taxes or tax rates. Their one and only function is to hear evidence as to whether or not properties called to their attention are appraised at more or less than their market value. If such is the case, the Board has the authority to change the appraised value. They cannot change your appraised value for any other reason. The Board can also hear appeals on denial of exemptions and green belt classification.

But See Us First

The Property Appraiser and his staff are at the service of the public, and will be glad to assist in all matters pertaining to county appraisals and exemptions.

Your Property Appraiser’s Office is YOUR office. Feel free at all times to visit and examine our records.

We maintain a public records room which is equipped with most county ownership maps, aerial photographs, U.S. Geological survey quadrangle maps, and national flood insurance maps, as well as on-line computer access to property information.

Each year, usually in August, property owners are mailed a notice by the Taxing Authorities called a Notice of Proposed Taxes or TRIM notice. This notice includes the dates, times, and places of budget meetings where tax rates are set by these agencies. Also in the notice will be information about how these tax rates could affect your individual tax bill.

These meetings are always public. Citizens are encouraged to participate in local governmental decision making.

Differing With The Property Appraiser’s Market Value Appraisal

If your opinion of the value of your property differs from the Property Appraiser’s appraisal, by all means come in and discuss the matter with us.

If you have evidence that the appraisal is more than the actual fair market value of your property, we will welcome the opportunity to review all the pertinent facts.

After talking with us, if you still find a significant difference between our appraisal and what you feel your property’s market value is, you may be heard before the Value Adjustment Board. A written application must be filed with the Clerk of the Value Adjustment Board. Petitions may be obtained from Property Appraiser or the Clerk.

Property Appraiser’s Response to COVID-19

AWARENESS

Our office is aware of the impacts that the COVID-19 crisis has had on our community and respect that many of our citizens have concerns about the value of their property as well as their property tax obligation during this challenging period.

ACTION

Under Florida law, county property appraisers must value every property in the state as of an effective date of January 1, 2020. Any impacts from COVID-19 would not impact January 1, 2020 property values, as we must analyze sales data and trends from 2019.

FUTURE

Our appraisers consistently monitor market transactions and trends. Any increase or decrease in sales prices which occur in 2020 will impact property values as of our January 1, 2021 valuation.

HOMESTEAD EXEMPTION

Due to the COVID-19 disruption, we are accepting late-filed homestead exemption applications until September 15, 2020. Please go to www.putnam-fl.com/app to see how you can submit your application.

Petition to the Value Adjustment Board

The Value Adjustment Board has no jurisdiction or control over taxes or tax rates. Their one and only function is to hear evidence as to whether or not properties called to their attention are appraised at more or less than their market value. If such is the case, the Board has the authority to change the appraised value. They cannot change your appraised value for any other reason. The Board can also hear appeals on denial of exemptions and green belt classification.

But See Us First

The Property Appraiser and his staff are at the service of the public, and will be glad to assist in all matters pertaining to county appraisals and exemptions.

Your Property Appraiser’s Office is YOUR office. Feel free at all times to visit and examine our records.

We maintain a public records room which is equipped with most county ownership maps, aerial photographs, U.S. Geological survey quadrangle maps, and national flood insurance maps, as well as on-line computer access to property information.